-

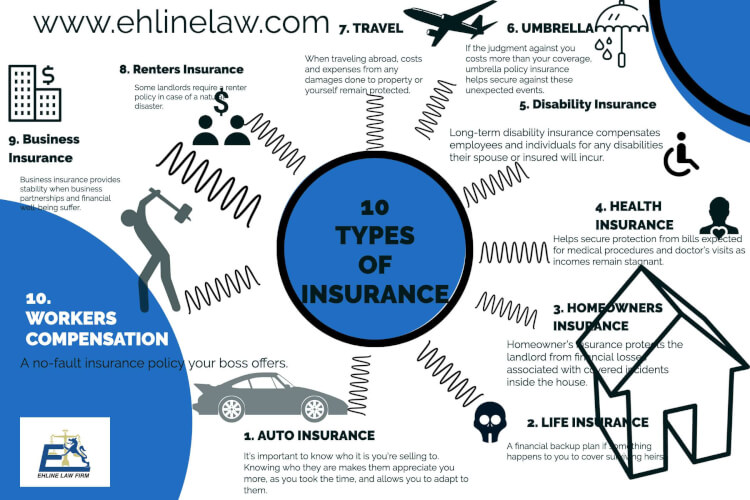

Ten Important Types of Insurance

-

Ten Important Types of Insurance

Here is where we help clients understand the ten important types of insurance offered by insurance companies for the maximum possible compensation. Are you having problems with nationwide insurance services and need insurance lawyer advice? Few families can handle the many insurance claim factors. Our attorney partners will help when an insurance company mistreats you. Ehline Law provides legal services to our clients.

Insurance Protects Individuals from Medical Expenses and Property Damage Claims

Medical bills in the US are astronomically high, and an average family can not afford the right medical care without proper insurance. Surgery costs, therapy, medical expenses, medicines, doctor’s visit, and more start piling up. This remains a financial burden on the family.

Medical bills are not everything. Insurance retrieves money to compensate for the loss of an object or an individual. For instance, you could lose your phone, but if it’s insured, your loss is minimal as you get compensation from the insurance company. You could die in a crash. So your spouse is covered.

Different Insurance Policy Types

There are different types of property and casualty insurance. Each insurance company offers different insurance policies and liability coverage. Here are some common types of coverage plans types a casualty insurance company offers.

Insurance can cover a house fire, a stolen bike, out-of-pocket expenses like a rental car, lost luggage, and hail damage to your car. It protects sick people or injuries when out shopping. Parents should not wait to learn about important protection to cover errors a dog may make (Ex: a dog bites a child in the face, etc.) Most states require employers to purchase certain insurance benefits for employees at no cost.

Auto Insurance

In case of an accident in a vehicle, you want to have this type of insurance on top of any health insurance plans or travel insurance. Most United States require minimum coverage before drivers are eligible to drive on the roads. Auto insurance should cover car damage risks to cars, including personal injuries, bodily injury, equipment, and parts property. Unlike worker’s compensation insurance, basic liability insurance is a fault-based policy designed to cover risks like lawsuits.

Whether a car accident or property damage repair, automobile insurance will give you financial liability insurance protection if you’re at fault. This is intended to pay for damages to vehicles and passengers. The premium varies depending on your age, the number of accidents you have had, or any historical connection with serious violations.

To date, younger drivers pay more, while more responsible, familiar, and experienced drivers pay less for auto insurance. However, the premium depends not only on individual stats but also on the crime rate in the region or even where you work. The more miles you drive, the higher your chances of getting into an accident. This can be a few hundred dollars annually.

Life Insurance

This type of insurance is a financial backup plan for your loved ones if something happens to you. When someone passes their property to surviving heirs, sufficient life insurance can help offset estate taxes. A life insurance policy allows buyers to nominate a primary beneficiary and other contingency beneficiaries to pass on the financial payments upon your passing. Life insurance can cover a certain term (Term Insurance), like 20 or 25 years.

Permanent life insurance coverages (whole life) cover the insurance buyer and their family for life as long as the monthly premiums are paid. Individuals can determine the cash value decedent’s family member can receive after their death. This could be anything the individual sets in addition to any amount sued for under the wrongful death statute, creating a retirement corpus and helping individuals regain control over their lives.

Since the likelihood of a younger individual dying is significantly less than those who are old, premiums for life insurance are relatively lower for young individuals. Women also lower premiums for a life insurance policy relative because women tend to live longer.

Health is also a major factor in determining life insurance costs. Those with a history of severe illnesses tend to die before others.

Homeowners Insurance

Homeowner’s insurance protects the landlord from financial losses associated with covered incidents inside the house. (Similar to personal property insurance).

A standard insurance policy of this sort would cover the event or these critical incidents:

- Vandalism

- Fire

- Biting dogs

- Theft/Burglary

- Lightning

- Storms.

Specific insurance might even come with flood insurance coverage in countries, states, or cities with greater chances of excess urban flooding. These types of insurance policies fund and pay for the repairs. In bad cases where the home is beyond minor repairs, the policy pays the owner to rebuild the entire home. Several options exist for consumers. Funds to cover the insurance vary according to the type of home, the home’s value, and the home’s location.

A home near storms may have a higher premium than a location with no chance of urban natural disasters. Your insurance provider will explain the difference if you cannot decide the extent of insuring your investment.

Health Insurance

According to the Kaiser Family Foundation, medical debt makes up almost half of all bankruptcies in the country. Health insurance pays for medical coverage, including surgery, medication, and even dental work in certain situations.

This helps secure the right type of protection from bills expected for medical procedures and doctor’s visits as incomes remain stagnant. These types of insurance also apply to personal injuries, so if you have a personal injury, you can claim health insurance reimbursement for medical emergencies. Your reimbursement amount depends on your health insurance plan. You must compare evidence of physical and mental damage to determine everything. You can claim lost wages or income if a personal injury has affected your work performance, resulting in unemployment.

Individuals avail of health insurance from designated medical providers on their insurance entity list. Going for medical care treatment outside the designated providers can lead to penalties. Medical coverage outside designated medical providers is against regulations. Customers must use the listed hospitals and marketplace for any emergency care service. If not, insurance contract coverage for certain types of illness or risks is barred.

The Patient Care Act started rebuilding policy changes covering dependents in 2010. Now younger kids and children remain on their parent’s healthcare plan till reaching 26 years. Medical coverage to patients or insurance buyers with pre-existing conditions is generally covered to safeguard your health.

Uninsured victims can still seek support and assistance, even with no finances. You can sign up for Social Security Disability (SSDI), MediCal, Medicaid, or Medicare provider specialists to insure a portion of costly charges.

Disability Insurance

The Social Security Administration claims that over one in four 20-year-olds receive permanent disabilities before retirement or age 67. Long-term disability insurance compensates employees and individuals for any disabilities their spouse or insured will incur. Employers may offer similar benefits to their employees through a casualty insurance company. Policyholders can get monetary compensation for the salary or income necessity lost due to any future disability risk.

Disability insurance works differently when compared to normal insurance. Forget lost property, belongings, or damage to object payments. The livelihood of an individual with disabilities from accidents receives coverage benefits.

Evidence Is Key To Disability Payments

For example, if a person earns $60,000 per year and becomes disabled due to a personal injury, the insurance company will determine the damages and pay a lost income. Long-term disability insurance might even pay for medical costs, including therapy, surgery, medication, and other associated costs depending on the medical evidence provided.

However, in reality, this subject remains a more complex event. Depending on the private insurer or Social Security, you might need to fulfill certain requirements before being eligible to draw on disability benefits. As you shop, it’s in your interest to ask your insurance agent what will happen with coverages over fluctuations in yearly income.

Umbrella Insurance Policy

If the judgment against you costs more than your coverage, umbrella policy insurance helps secure you against these unexpected events. Suitable umbrella insurance policies cover policyholders to replace a range of losses.

This type of insurance liability coverage isn’t covered under other insurance policies. Umbrella policies give a policyholder peace of mind—many unexpected negligence costs to the policyholder and dependents. So if your kid is not a great driver, you can sleep comfortably at night, knowing umbrella policies pay this.

Travel Insurance

One type of essential quality coverage you should discuss is travel, trip, and collision insurance. When traveling abroad, costs and expenses from any damages to property or yourself remain protected.

A travel insurance policy covers important costs. Some countries make this a prerequisite before your trip. Unfamiliar roads and failing to know local driving ethics can land you or your passenger in the hospital.

Renters Insurance

Renters insurance provides coverage for the policyholder’s assets, possessions, and liability in instances involving many losses. Some landlords require a renter policy in case of a natural disaster. Sometimes, the owner’s home insurance won’t cover a tenant’s personal property.

Business Insurance

Here are the wellness basics. Imagine the losses, fines, and damages to structures during their course of activities. Damages to the office created operational bottlenecks, resulting in lower profits. Business insurance provides stability when business partnerships and financial well-being suffer. A limited liability company (LLC) won’t shield all liabilities. It would help if you had the right insurance.

Consult with an insurance broker to obtain business insurance and fill coverage gaps. A talk with your insurance company can help determine business damages for the coverage purchased. Search for financial protection, so you make a business claim later in the process.

Workers Compensation

Your employer and not you must carry workers compensation insurance. Regulations define this as a no-fault type of insurance policy your boss’s insurance agent offers. It won’t cover a personal property damage claim. It’s usually not enough to cover a permanent injury.

Limitations on Your Insurance Policies

Whatever insurance you decide to get, read the insurance policies and the restrictions on accessing policy limits. See whether the insurance provides enough coverage in case of any adverse events and gives out lump sum money.

Often people buy insurance in the hopes that they will cover their damages. In short, yes, insurance covers the injuries mentioned in their list. But insurers often give as little money as possible, which helps protect investors. But it’s also bad faith, and not everyone gets justice.

Is Your Insurance Company Treating You Fairly?

Even with the suitable types of insurance, a bad faith insurer would instead work in their best interests than obey the law. They’ll use delay tactics and lowball a lousy settlement offer. May you have months or years to file a personal injury or California business claim?

Speak With a Top Insurance Lawyer Today

If you’re facing difficulties with a personal injury or property damage caused by a negligent person, Ehline Law’s team of attorneys will fight for your insurance claim. Contact us now at (213) 596-9642 for more information. Our job is to help you before purchasing different types of insurance or when you cannot handle the many factors surrounding benefits.

Categories

Michael Ehline

Michael Ehline is an inactive U.S. Marine and world famous legal historian. Michael helped draft the Cruise Ship Safety Act and has won some of the largest motorcycle accident settlements in U.S. History. Together with his legal team, Michael and the Ehline Law Firm collect damages on behalf of clients. We pride ourselves in being available to answer your most pressing and difficult questions 24/7. We are proud sponsors of the Paul Ehline Memorial Motorcycle Ride, and a a Service Disabled Veteran Operated Business. (SDVOB.) We are ready to fight.

Go here for for More Verdicts and Settlements